travel nurse tax home rules

The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future tax liability. Make sure you qualify for all non-taxed per.

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Your taxable income creates an effective.

. You may need to pay four taxes as an independent contractor. This likely wont apply to you as a travel nurse. There are two ways of establishing a tax home.

Deciphering the travel nursing pay structure and tax rules can be complicated. Here is an example of a typical pay package. 153 in self-employment taxes Social Security and.

Therefore we must prove that we have a home to go away from. What is a Tax Home Rules to Stay Compliant with the IRS Travel from. The Travel Nurse Season is here and it shows The Travel Nurse working in the Tele CCU PCU Units provides care for patients requiring special heart monitoring equipment.

By Rachel Norton BSN RN. Tax homes tax-free stipends hourly wages. Tax home home is where the heart is.

Simply put your tax home is the region where you earn most of your nursing income. Travel Nurse Tax Home Rules. But not according to the irs.

Prove your primary residence is also the main area in which you earn income. Okay so we are learning as a Travel Nurse we must travel away from home to receive that tax-free money. Have a question please do not hesitate to call us at 855-335-9924.

Federal income taxes according to your tax bracket. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Instead of looking at the primary place of incomebusiness it allows the tax.

Or utilize our Live Chat option we. For true travelers as defined above the tax rules allow an exception to the tax home definition. Proposed Regulation Board of Nursing.

NEWARK The Board of Nursing has proposed amendments and new rules to implement PL. 20 per hour taxable base rate that is reported to the IRS. Having a tax home allows you to save on taxes for certain travel expenses tax.

Numerous 813 26 week. You declare a tax home and take a travel nursing contract with a 30000 base salary and 15000 in tax-free stipends. What is a tax home and what.

250 per week for meals and incidentals non-taxable.

Travel Nursing Close To Home Debunking The 50 Mile Rule

Travel Nurse Tax Guide 2022 Travel Nursing

Travel Nurse Taxes Overview Tips

Understanding Travel Nurse Taxes Guide 2022

Travel Nurse Tax Home And What It Means Medpro Healthcare Staffing

Overlooked Tax Deductions For Nurses And Healthcare Professionals The Handy Tax Guy

4 Must Know Rules To Tax Free Money For Allied Health Travelers Nomadicare

How To File Taxes As A Travel Nurse Travel Nursing Youtube

Travel Nurse Taxes What Are Tax Homes Trusted Health

A Guide To Travel Nursing In Your Own City And State Trusted Nurse Staffing

Understanding 2021 Travel Nursing Tax Rules Nursefly Community Hub

Understanding Tax Home Requirements In Traveling Nursing And Avoiding Irs Audits Nurse Cheung Youtube

How To Do Taxes As A Travel Nurse Stability Healthcare

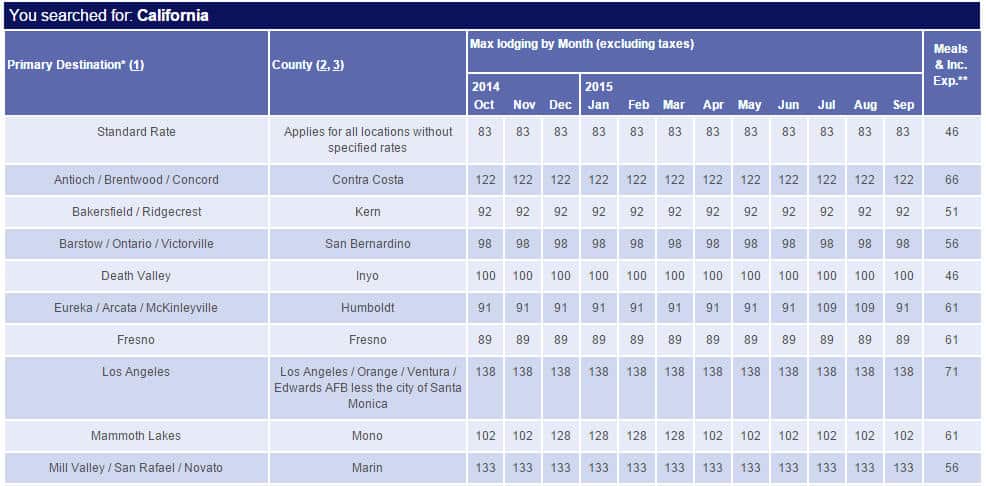

6 Things Travel Nurses Should Know About Gsa Rates

Understanding Taxes As A Travel Nurse American Nurse

Ttatn 018 Travel Nursing Tax Free Money Bluepipes Blog

Travel Nursing Tax Guide Wanderly

Travel Nurse Taxes What Are Tax Homes Trusted Health

Travel Nursing Pay Qualifying For Tax Free Money 2 Bluepipes Blog